Setting up taxes for your webshop

— Where do I configure my taxes in Woocommerce?

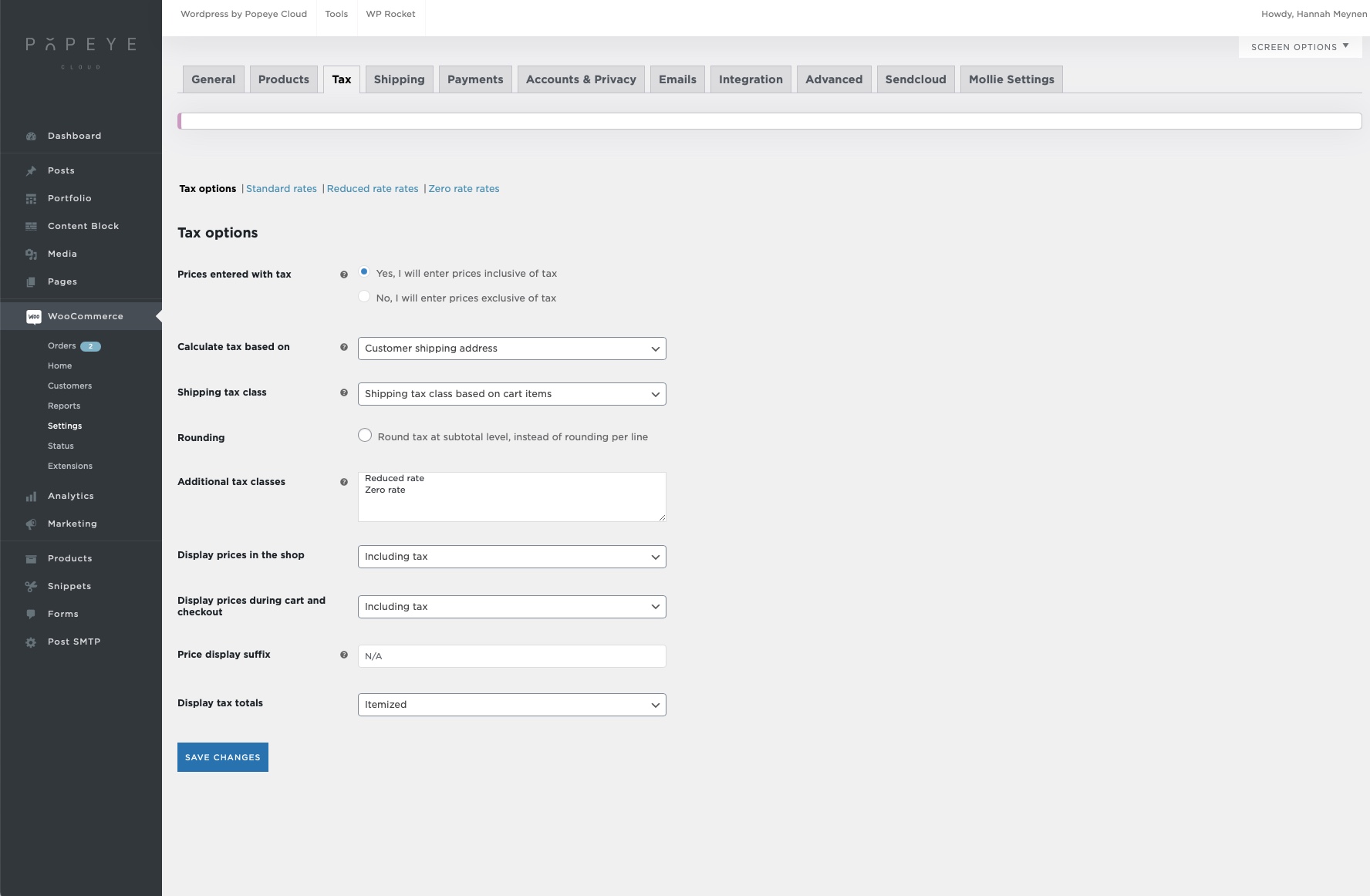

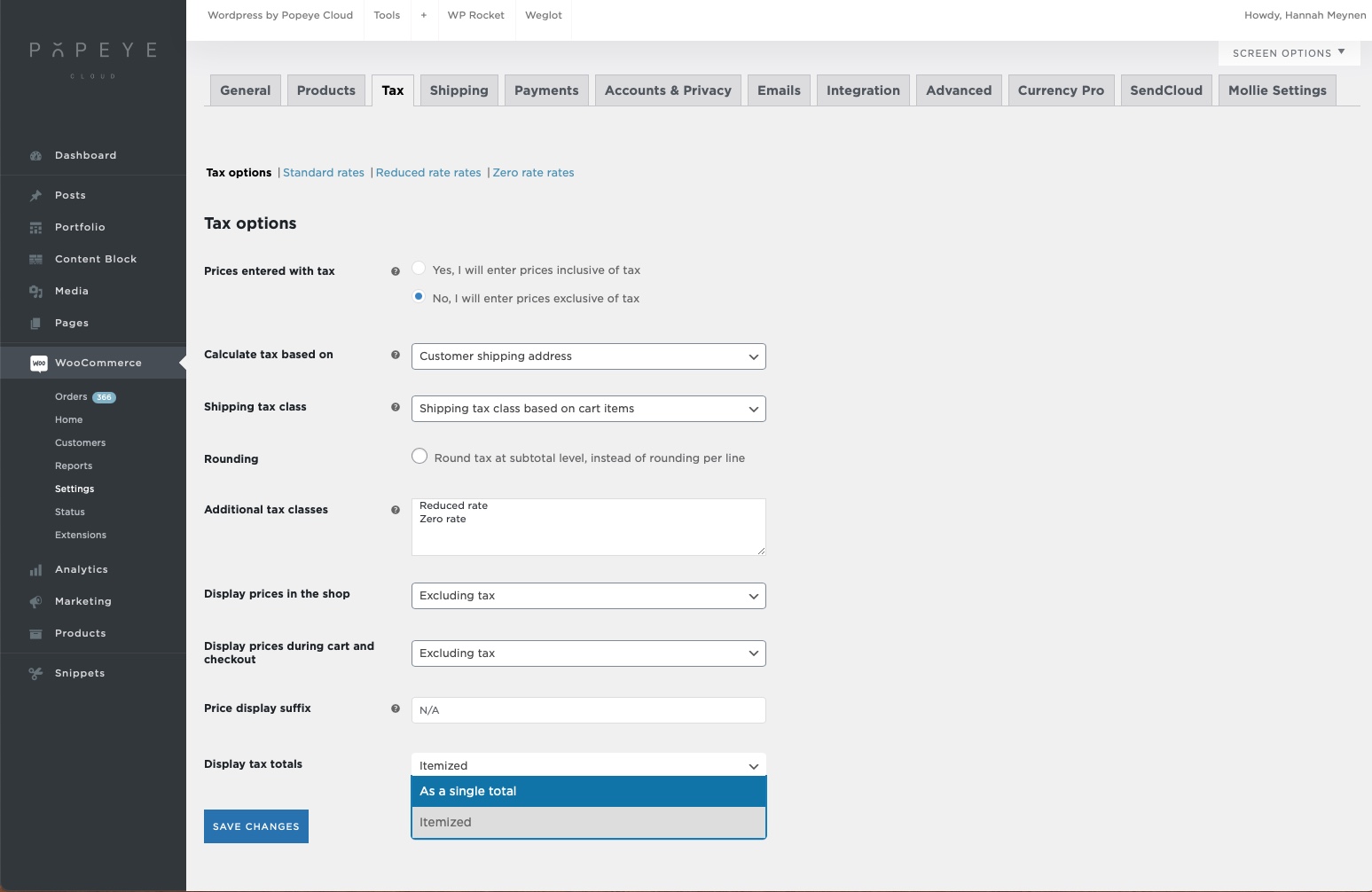

Go to Woocommerce > settings > go to the tab ‘tax’

You now find yourself in the tax options

Important to enable the taxes!

- Prices entered with tax: choose whether you will enter your prices with or without tax. This option is important as it will affect how you input prices. Changing it will not update existing products!

- Calculate tax based on: this option determines which address is used to calculate tax.

- Shipping tax class: optionally control which tax class shipping gets, or leave it so shipping tax is based on the cart items themselves.

- Additional tax classes: list additional tax classes you need below (1 per line, e.g. Reduced Rates). These are in addition to “Standard rate” which exists by default.

- Display prices in the shop: choose if you want to display them with or without tax

- Display prices during cart and checkout: same as above

- Price display suffix: Define text to show after your product prices. This could be, for example, “inc. Vat” to explain your pricing. You can also have prices substituted here using one of the following: {price_including_tax}, {price_excluding_tax}.

Ideally your tax settings should look like this, for example: (only if you have one VAT rate) if you have more for example 6% and 21% please contact us and we will setup the taxes together.